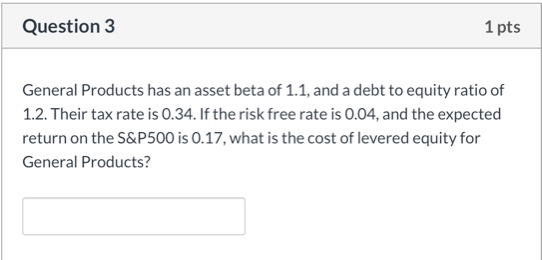

Debt To Equity Ratio Of 1 2

We can also see how reclassifying preferred equity can change the d e ratio in the following example where it is assumed a company has 500 000 in preferred stock 1 million in total debt.

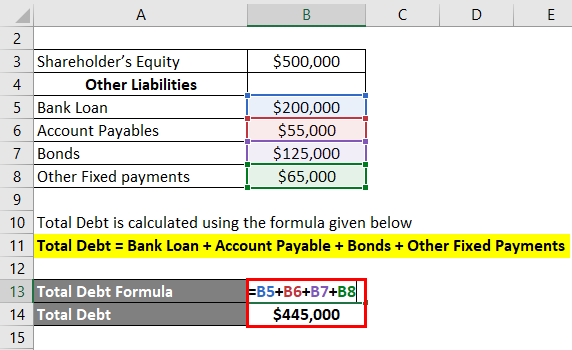

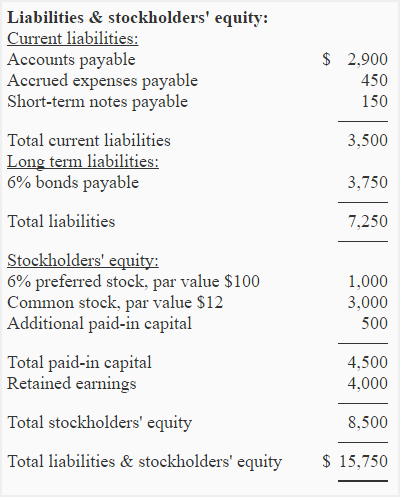

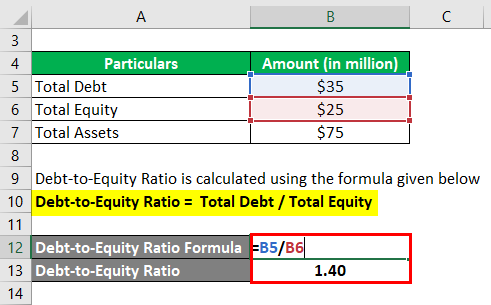

Debt to equity ratio of 1 2. The preferred debt to equity ratio. The company also has 1 000 000 of total equity. The promoter does not have to look for loans from friends and relatives cross investment. For example if a company s total liabilities are 3 000 and its shareholders equity is 2 500 then the debt to equity ratio is 1 2.

This company would have a debt to equity ratio of 0 3 300 000 1 000 000 meaning that total debt is 30 of total equity. This ratio is not expressed in percentage terms book excerpt. Using the balance sheet the debt to equity ratio is calculated by dividing total liabilities by shareholders equity. Companies with a higher debt to equity ratio are considered more risky to creditors and investors than companies with a lower ratio.

But a high number indicates that the company is a higher risk. That can be fine of course and it s usually the case for companies in the financial industry. Excel template that calculates the weight of total. Some in the finance industry will just use interest bearing debt rather than total liabilities in this ratio.

A debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets. A high debt to equity ratio shows that a company has taken out many more loans and has had contributions by shareholders or owners. However if the co. These funds can be utilised for generation of income higher than the project.

While some very. What is the debt to equity ratio. The debt to equity ratio also called the debt equity ratio risk ratio or gearing is a leverage ratio leverage ratios a leverage ratio indicates the level of debt incurred by a business entity against several other accounts in its balance sheet income statement or cash flow statement. From the viewpoint of company 2 1 ratio is always better.

A lower debt to equity ratio usually implies a more financially stable business. For example suppose a company has 300 000 of long term interest bearing debt. The result is the debt to equity ratio. The optimal debt to equity ratio will tend to vary widely by industry but the general consensus is that it should not be above a level of 2 0.

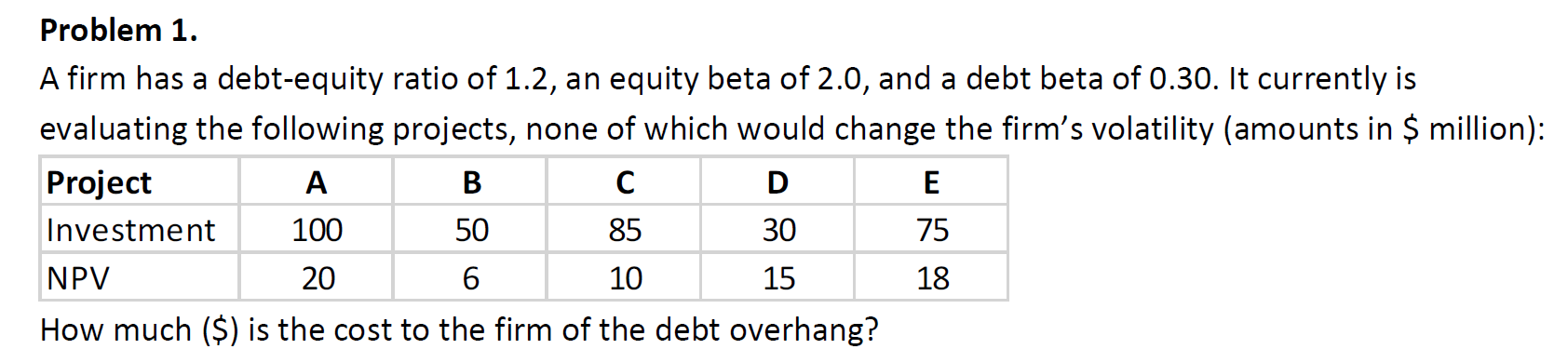

Firm hl however has a debt to equity ratio of 1 2 and pays 10 percent interest on its debt whereas ll has debt to equity ratio of 0 7 and pays only 8 percent interest on its debt.

.jpg?width=600&name=Long_term_Debt_to_Equity_Ratio%20(1).jpg)

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)